The need for speed

In today’s high-frequency trading landscape, stakeholders expect rock-solid connectivity and exceptional network performance. The ability to capture, process, and analyse vast volumes of data at speed to detect performance loss and resolve issues fast is a key differentiator for trading venue providers and their clients.

However, firms face many challenges that are not adequately addressed by today’s available technology:

Quants review financial data but this often misses information about the performance over the network, and it misses latency information.

Certain quant analysis is not fast enough to feed back into live trading decisions, or is not accessible by operational teams who need to use it to inform real-time intraday decisions about connectivity, infrastructure, counterparties, etc.

Recent advances in AI and GPU technology have yielded many innovations that attempt to meet this challenge. Of these, AI-powered edge analytics offers the most promise in addressing these issues.

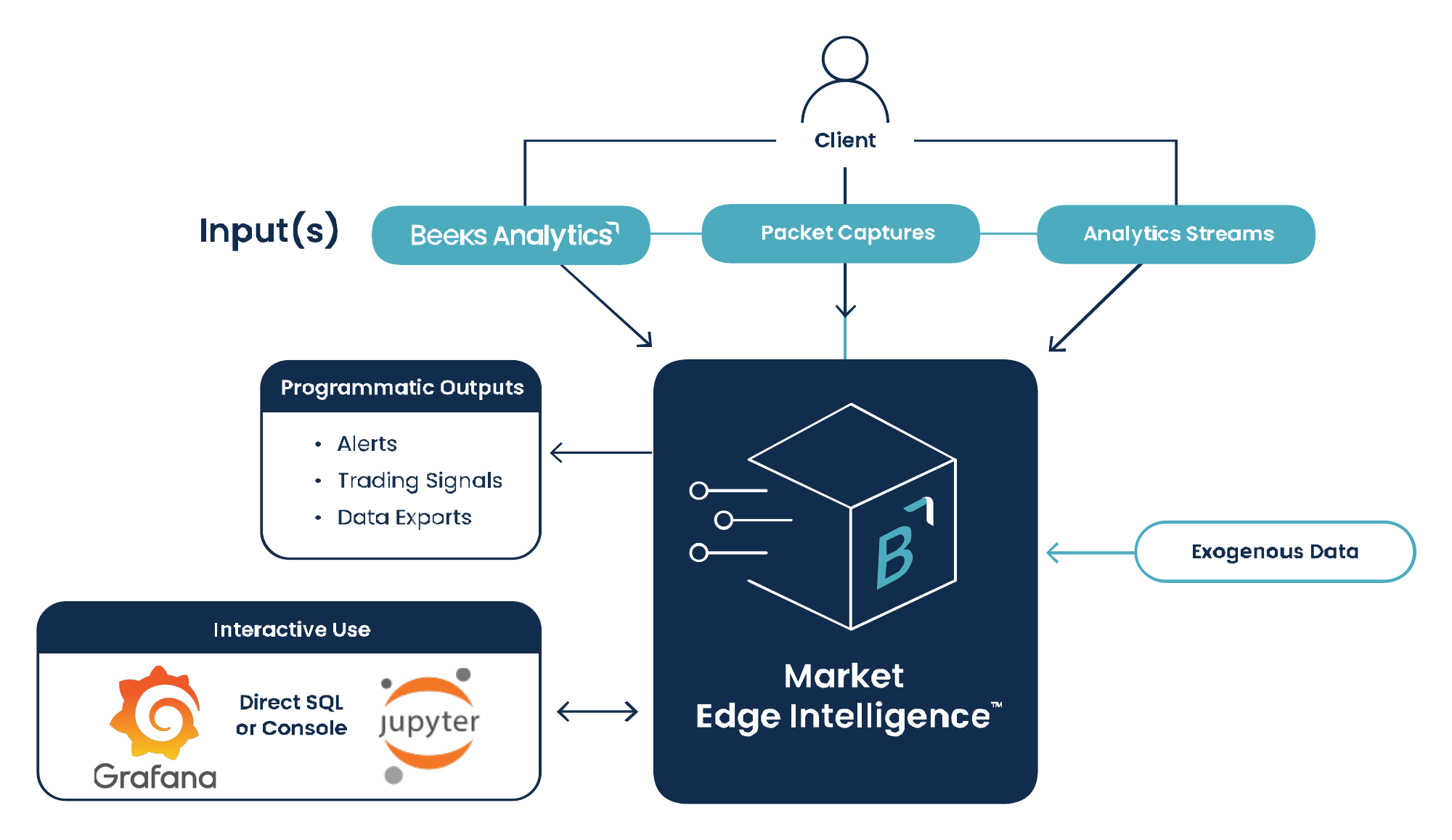

This paper describes how the Beeks Analytics architecture contributes to and enhances customers' existing AI strategies; and then expands on how the Beeks Market Edge Intelligence™ product supplements this further by delivering low latency AI-powered analytics closer to the source data.:

Market Edge Intelligence™ is available as a standalone product to operate on customer’s own data (Analytics Streams, PCAPs) that they collect from the edge but struggle to analyse.

Market Edge Intelligence™ is also available as part of Beeks Analytics.